In the final part of our series on retail trends, pressure points, and insights in 2024, authored by Henrietta Bamford, we talk to businesses about how they are coping with the twin pressures of sustainability and profitability and the effort to achieve net zero targets.

Want to read the first two articles in the series? Just click through below:

Evolution of Customer Data in Retail

How are brands enhancing their O+O experiences

Balancing Net Zero Targets - consumer and retail challenges

A former Procter & Gamble Senior VP stated:

"There’s a fundamental conundrum at play – a clear willingness from businesses to be more sustainable versus how to do so in a way that creates value for business."

When interviewing various brands on the topic, this pressure became increasingly apparent. While the majority of businesses showed intention and awareness to be more sustainably conscious, they relayed the difficulties of making impactful changes that did not simultaneously affect profitability.

This final piece of research outlines why supply chains are so important to achieving net zero; and how some leaders are stepping up to the task of hitting targets.

We also examine why it is so challenging for brands to find a route to net zero that adds value through consumer preference.

The impact of emissions data

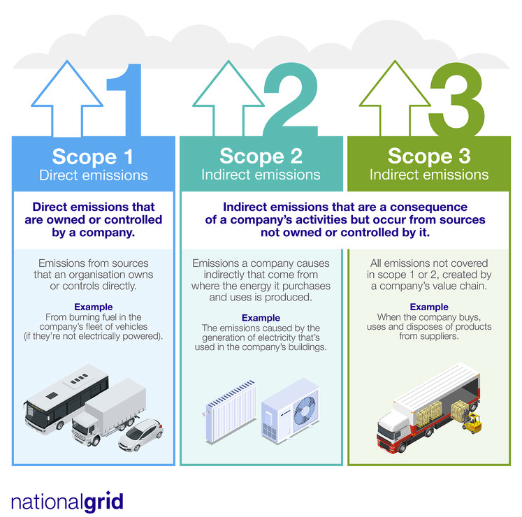

Some of the largest organisations in the UK are required to disclose their Scope 1 and 2 emissions in annual reports, in accordance with the Streamlined Energy and Carbon Reporting (SECR) framework. Reporting Scope 3 emissions is still largely voluntary.

The diagram below, produced by the National Grid, illustrates Scope 1, 2 & 3 and shows where in the supply chain emissions originate.

According to an investment director in the Freshminds network, it won’t be long before the government asks businesses to fully disclose Scope 2 and 3 data as part of their climate risk. As a result, many are proactively clamping down on the accuracy of their Scope 3 emissions.

The difficulty lies in how to gather data from further down the chain because it is much more complicated for businesses to regulate how consumers use a product once it’s purchased. This is one of the reasons demand has increased for carbon consultancies, advisory firms, and other associated software because businesses need help making sense of their emissions data so that they can ascertain a baseline before regulation requires them to.

Will Scope 3 data make a difference?

So, if businesses can identify where their emissions originate in Scope 3, would they consider more sustainable alternatives?

A consultant who worked at John Lewis said: “Yes, most sustainable suppliers will win out in the end”, but we should not underestimate the “material decision to change aspects of a supply chain for sustainable motives”.

In 2021, Shell unveiled a project to reduce the carbon intensity of production. They were promoting the use of cooking oil and animal waste to make biodiesel and sustainable fuels. But earlier this year, they announced a pause on construction of a huge plant in Rotterdam. The CEO, Wael Sawan, said Shell needs to become more "disciplined and value-focused".

For a company the size of Shell to withdraw efforts, it is reasonable to see why so many businesses struggle to find a commercially viable route to net zero.

Currently, costs are broadly too high to opt for these alternatives, and therefore, most can’t act because of the long-term commercial ramifications. “At the end of the day, CEOs need to hit targets”, commented a Managing Director at Accenture.

A former strategy consultant at McKinsey told us that consumers ultimately still buy for “price, quality, and convenience”. As a society, we are far from consistently choosing the more sustainable options at the point of purchase because they still lack quality and value.

Some larger organisations are trying to improve the sustainable choices available to consumers. This year, Shein rolled out its Circularity Fund worth $200 million to invest in smaller, more sustainable businesses within the UK and EU that work with recycled materials and greener fabrics. The fund addresses the whopping 10% of global emissions that the fashion industry produces – perhaps more a strategic move to reframe the brand away from its fast fashion legacy.

Operating holistically to contribute to net zero targets

Many of our conversations touched on waste reduction as a common way to cut emissions. Others, however, outlined more holistic approaches across their supply chains.

A restaurant chain, founded in South Africa, told us that most of their operations are purposefully integrated in their local region. The former Head of Operations said they “configure their supply chains to improve the socio-economic situations”, using ingredients produced by local farmers and using local artworks and music in their restaurants.

We interviewed one of the first mainstream high-street brands in the UK that put environmental sustainability at the forefront of its brand promise. It’s a business case for creating shareholder value through an ESG-first strategy which drove its growth for 20 years, engaging with fair trade communities, locally sourced ingredients, and refillable schemes. The brand has since struggled to differentiate from politicised values adopted recently in the industry. The former Head of Strategy said it had always been a ‘purpose-led company’ with huge considerations across the supply chain - a view that being more sustainable was a value creator rather than an additional cost.

A strategy manager of a top grocer remarked that squeezed margins are perhaps the biggest influence on supply chains:

"Everyone has net targets, but how they are actively prioritising them depends on other efficiencies across the supply chain…For grocery stores, being price competitive will always take precedence. If companies can be competitive and reduce their carbon footprint in the process then great, but being sustainable is still not a core business motive – not until legislation forces it to be."

Is legislation a good enough reason for companies to double down on their efforts?

Is there enough incentive for businesses to be more sustainable?

As a previous COP26 host, the UK moved very quickly to drive regulations and show the world that we’re at the forefront of the energy transition.

The former SVP at Proctor & Gamble said:

“There was a clear sense of competition and one-upmanship with the EU’s Green Deal striving to be the first climate-neutral continent”.

By October 2021, the UK’s Net Zero Strategy set out policies to decarbonise all sectors in the UK economy and reach net zero targets by 2050” (and a further target reducing emissions by 78% by 2035).

But did this set the bar too high for businesses not just to achieve, but in which to thrive?

If we take the farming industry as an example, it is an extremely static sector. When met with substantial restrictions, farmers will resist the pace of this change, especially as there has been very little to help them achieve these targets. Government subsidies are 50-70% lower than what farmers received in 2020.

If we subsidise our farmers, the industry should become greener, which will help to ensure consumers make greener choices at the point of purchase. According to the P&G employee, in Asia, they set smaller yet more achievable targets across the continent, which is conducive to business growth and accessible rewards.

In contrast, our government is forcing sectors to move very fast with very little incentive.

“It’s a classic case of carrot and stick – the UK and EU are only using the stick. We need to create experiences that are superior to what has been before, making the sustainable path more irresistible and profitable than other options”.

In addition, there is uncertainty around whether current targets set by governments will remain the same in 12 months with half the world having gone through a national election this year. Companies will likely have to rethink certain investments if they’re not 100% confident regulations will exist in their current form.

Conclusion

We have seen and heard that there is a culture for businesses to nurture sustainably conscious brands. Trials for reusable packaging, recycling stations, and refillable schemes are being launched more regularly which signals organisations are doing more to align their operations with the SECR Framework.

But we need to try harder to ensure businesses thrive by acting more sustainably. If there is more value (quality, quantity, and price) for consumers when they choose sustainable products and services, we will be addressing how to mitigate scope 3 emissions.

This will be achieved if the UK government shows more support to the retail and consumer sector through more incentives and setting regulations that are fair and conducive to long-term growth.