Is the best time to formulate an acquisition strategy in the middle of a bear market?

While it may seem counterintuitive to some, we make the argument that companies that invest little and often tend to grow more sustainably.

In our previous M&A article, we explored how assessing the competitive performance of your existing portfolio is an essential tool for growth. Once you’ve defined your strong points and are aware of potential areas of growth, the next question is: how to articulate an acquisition strategy in this environment?

Currently, the economic situation is characterised by a drop in the value of public and private companies. This is largely due to the fact that inflation and interest rates are still high, and growth is minimal, even if it appears we have avoided an outright recession for now.

What this article suggests is that in markets like these, the focus should move from a strategy of chasing low-priced assets to crafting a mid-term serial acquisition programme.

Are small investments best?

The short answer is that small is best, often more efficient, and that the consistent implementation of an inorganic growth strategy generates more revenue.

There is an empirical fact in the M&A space that, in aggregate, public companies that perform a series of smaller acquisitions throughout a longer period generate more growth (measured by shareholder return) than those that go for one-off large acquisitions. Financial Management, Volume 47, Issue 4

However, there is a common counterargument that most practitioners use. A long list of very robust academics and consultants dating back to before the 1990s argue that M&A destroys more value for the acquirers than it creates.

But most of the value destruction comes from large M&A deals that obscure the small systematic M&A strategies like the one from Bunzl in the UK (225% return on stocks in the last 10 years).

This is also what PE firms do better.

McKinsey did not invent the concept of “roll-up”, “bolt-on”, or “string of pearls” acquisitions. They are just reframing an established fact that can be replicated by others engaging in an M&A strategy. The point they make is that M&A can be very risky if done the wrong way.

Large, flashy acquisitions often appear in the press but can cause significant value destruction. Small, often and focused seem to give the best results.

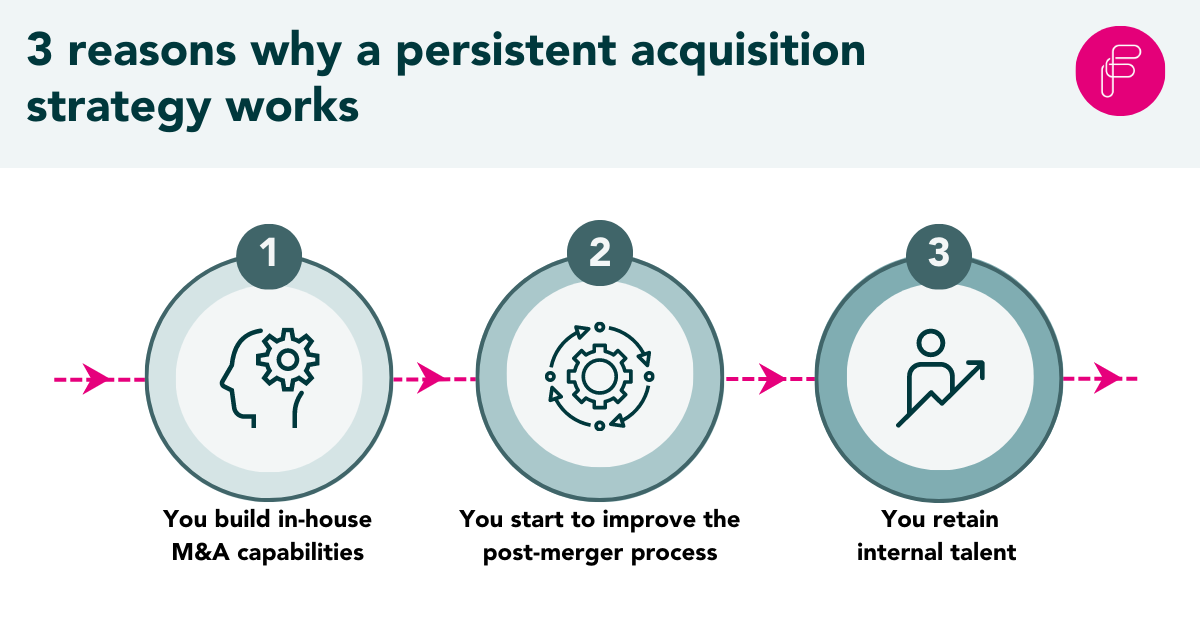

Three reasons why a persistent approach is effective

Small, often and persistent, that’s the mantra behind many thriving acquisition strategies.

According to research by McKinsey, ‘small’ equates to deals worth less than 30% of a company’s market cap (more than that is too big and inefficient) and often means 3.6 median deals, but it can be as much as 5-15 deals per year.

To go back to the Bunzl example, it has acquired between 5 -15 companies since 2004, with an average acquisition size of £40mn in the last 5 years. However, the most important point in this equation appears to be keeping a persistent strategic focus.

There are 3 main reasons why persistence works.

1) In-house M&A function: The first is that a persistent approach builds an in-house M&A institutional muscle memory that translates into better skills to identify the right company and pay the right price for them.

2) Efficient improvement process: It creates the institutional know-how to improve the post-merger process.

3) Internal talent retention: In the M&A markets, success breeds success. An ongoing M&A operation helps companies retain talent and receive better financing deals for what is perceived by banks as a long-term opportunity.

.png)

If you don’t have the in-house capacity, partnering with a company can fill the expertise sinkhole. They can ensure you have knowledge of target identification, pricing, due diligence, and post-merger integration.

Ensure your implementation is focused

Implementation can dilute the benefits of a persistent acquisition strategy. And that is why it needs to carry particular attention.

As mentioned in the introduction, this article assumes that the company has a clear portfolio or business unit strategy. Once that is defined, the next step is then distilling the key M&A themes and selecting the top 3 that can benefit the most from an inorganic growth approach.

One way of doing this is by organising a workshop with experienced deal-makers to provide feedback on specific ideas and to help build consensus in an organisation with multiple priorities.

The next step is using a scorecard methodology to score the top companies based on a company’s strategic preferences and to translate those results into a coherent M&A strategy for the long term.

Only after the process described above is concluded should a company enter the deal funnel (from diligence to negotiation and integration), always assuring that the deal is in line with the M&A strategy set by the upper management.

So, once the benefits of focusing on small persistent deals are understood, the implementation takes 3 steps:

1) Clarifying the M&A themes

2) Creating a roadmap of acquisitions using a real-life short list of targets

3) Entering the deal funnel ending with an integration of the company

All these steps usually require the use of specialised external partners that can provide expertise at every step of that deal journey.

Final thoughts on the current market and your acquisition strategy

At the time of writing, Satya Nadella has been hinting that he is expecting the worst of the tech downturn to be soon over.

On the M&A front, the appreciation of the dollar relative to other currencies has increased the potential for acquisitions in non-dollar markets, leading to some speculation on the possibility of substantial M&A movement in the UK.

From an industry perspective, the post-pandemic crash of some biotech companies’ valuation has increased the appetite for larger players. These anecdotal events point to the cyclical nature of M&A activity. As the market rebounds, as they have done periodically over the past 50 years, more companies would want to explore the M&A route, which can be extremely counterproductive.

Here we have argued that the best time to rethink or create an inorganic growth strategy is at the bottom of the bear market. This will help build or rebuild the institutional M&A muscle that is needed while prices are still relatively low.

However, for it to be successful, the strategy gains to be focused on the structured acquisition of small companies for a relatively long period of time.

Additionally, a major part of acquisition success relies on the right connections, from interim consultants to a team of researchers; explore how the Freshminds network can help here.

Want to read the full article? Contact us.